The Discover it® Student Cash Back and Chase Freedom® Student credit cards top the list for college students. The Capital One Savor One Student Card also stands out for its rewards.

Navigating the world of credit can be the start of a financial education for any college student. A credit card, chosen wisely, can set up a young adult for future success by building a positive credit history and promoting responsible spending habits.

It’s essential to opt for cards that offer generous rewards, have no annual fee, and provide student-friendly benefits. Managing a credit card also allows students to learn budgeting and the importance of paying bills on time. Selecting from the best credit cards designed specifically for college students can offer a blend of financial flexibility and the opportunity to earn while they learn. These top picks are tailored to fit the student lifestyle, offer cash back on purchases, and come with additional perks such as low interest rates and no annual fees. With the right credit card, students can enjoy the convenience of cashless payments while establishing a solid financial foundation.

Credit: www.cnbc.com

Selecting The Best Credit Card For College Life

Balancing Rewards With Education Expenses

Smart spending can earn you rewards. Look for cards offering cash back on purchases. Some cards give extra points for books, supplies, or food. These rewards can help with college costs. Yet, always check for hidden fees. A table of credit cards with their rewards can guide you better. Key Features of Student Credit Cards:- No annual fee

- Cash back on everyday purchases

- Bonus rewards for academic success

Understanding Credit Building For Students

Building credit is crucial. A good credit score opens doors to future loans. On-time payments and low credit utilization aid your score. Certain cards even offer free credit score tracking. It helps you monitor your progress. You learn responsible credit use quickly. Must-have Credit Card Features for Students:| Feature | Benefit |

|---|---|

| No annual fee | Saves money |

| Low interest rate | Reduces cost of borrowing |

| Credit education resources | Improves financial literacy |

Review Of Credit Card Features For Students

Comparing Interest Rates And Fees

Credit cards for students often come with competitive perks. Look for low interest rates. They keep costs down if you carry a balance. Also, watch for minimal fees. Some cards offer zero annual fees. Others charge for late payments or going over your limit. We put together a comparison: Add more rows as needed| Card Name | APR | Annual Fee | Late Payment Fee |

|---|---|---|---|

| Card A | 14% | $0 | Up to $35 |

| Card B | Variable 11%-19% | $0 | Up to $25 |

Exploring Cards With No Credit History Requirements

Many students start with no credit. Finding a card can be tough. Some cards are designed for this. They don’t check past credit. This allows new users to join. Benefits may include:- Educational resources to build credit responsibly

- Credit limit increases after consistent on-time payments

- Rewards like cash back on student-friendly categories

Top 10 Credit Cards Tailored For College Students

Evaluating Cashback And Rewards Programs

As a student, making every dollar count is essential. Cashback and rewards programs can help you earn while you learn. Here’s how these cards can benefit you:- Flat-rate cashback: Get the same rate back on all purchases.

- Bonus categories: Earn more in areas like dining, travel, or groceries.

- Rotating rewards: Maximize cashback by tracking changing categories.

| Credit Card | Flat-Rate Reward | Bonus Categories | Rotating Rewards |

|---|---|---|---|

| Card One | 1% | Dining, Travel | N/A |

| Card Two | 1.5% | Groceries, Gas | N/A |

Perks For Students: Discounts And Offers

Look beyond cashback. Cards often offer deals that slash expenses. Highlights include:- Textbooks discounts: Save big on study materials.

- Tech deals: Access lower prices on gadgets and software.

- Subscription savings: Cut costs on streaming services and more.

| Credit Card | Textbooks | Tech | Subscriptions |

|---|---|---|---|

| Card Three | 10% off | Discounts on laptops | Free months of music streaming |

| Card Four | 5% cashback | Exclusive app offers | Bundle deals |

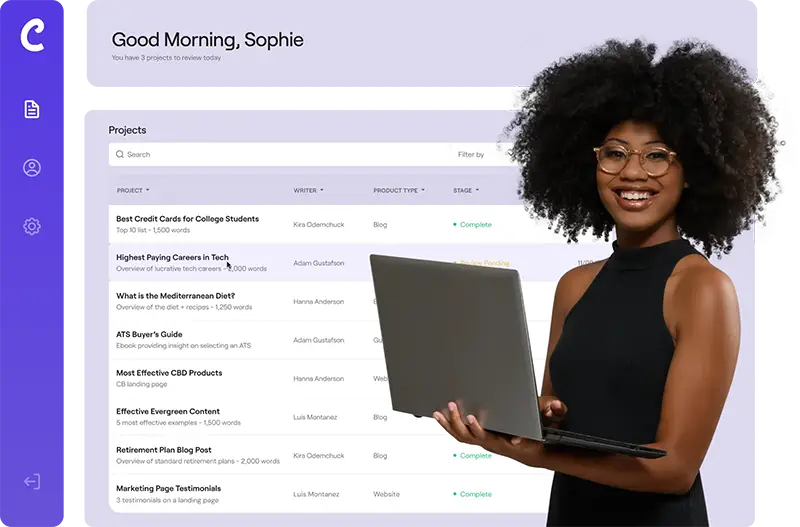

Credit: compose.ly

Smart Credit Practices For First-time Cardholders

How To Maintain A Healthy Credit Score

Building a healthy credit score opens doors to future financial opportunities. Start with these simple steps:- Pay your bills on time. Timely payments are critical.

- Keep credit utilization low. Aim to use less than 30% of your available credit.

- Only apply for credit you need. Too many applications can hurt your score.

- Review your credit reports. Check regularly for errors.

Avoid Common Pitfalls: Late Payments And High Balances

First-time cardholders often make mistakes that impact their credit. Learn to sidestep these pitfalls:| Pitfall | Risk | Prevention |

|---|---|---|

| Late Payments | Hurts credit score and incurs fees. | Set calendar reminders or auto-pay. |

| High Balances | Increases credit utilization ratio. | Monitor spending and set limits. |

Credit: time.com

Frequently Asked Questions On Top 10 Best Credit Cards For College Students

Which Credit Card Is Best For Student?

The Discover it® Student Cash Back card offers great rewards and no annual fee, making it an excellent choice for students.

Which Type Of Credit Card Is The Best For A College High School Student?

The best credit card for college and high school students is generally a secured or student credit card. These cards often feature lower credit limits, financial education resources, and may help build credit with responsible use.

What Is The #1 Credit Card To Have?

The best credit card varies based on individual financial needs and spending habits, with top picks often including rewards options like Chase Sapphire Preferred or cash-back cards such as Citi Double Cash.

Conclusion

Selecting the right credit card is a crucial step for college students aiming to build their credit wisely. Our list of the top 10 cards offers diverse options to suit different needs. Remember, responsible use is key to financial success.

Choose wisely and start your credit journey on solid ground. Keep swiping smart!