Dental financing companies offer patients tailored plans to manage treatment costs. They provide flexible payment options for various dental services.

Navigating dental care expenses can be challenging without insurance or significant savings. Dental financing companies step in to fill this gap, making oral healthcare more accessible and manageable. With a range of financing solutions, these companies allow patients to receive necessary treatments now and pay over time.

This approach not only eases immediate financial burdens but also encourages individuals to prioritize their dental health without the stress of upfront costs. By spreading payments out, patients can maintain both their financial stability and oral hygiene effectively.

Credit: www.icarefinancialcorp.com

Navigating Dental Care Costs

The Reality Of High Dental Expenses

Dental care is not a luxury—it’s essential for maintaining overall health. Yet, the cost can be steep. Routine procedures and unexpected treatments add up quickly, making it hard for many to afford care. The reality is that high dental expenses can lead to neglected oral health.- Crowns, bridges, and implants come with a high price tag.

- Orthodontic treatments can be a significant financial burden.

- Without proper care, small issues may lead to more expensive procedures.

Insurance Vs. Out-of-pocket Payments

Understanding the differences between dental insurance and out-of-pocket payments is vital. Insurance plans can buffer the financial impact of dental work but come with their own limitations.| Insurance Coverage | Out-of-Pocket Payments |

|---|---|

| May cover routine check-ups. | Full control over choice of treatments. |

| Typically has a yearly maximum. | No yearly limits. |

| Limits on types of treatments. | Access to a wider range of procedures. |

| Possible waiting periods. | Immediate treatment without delays. |

- Setting a budget for unexpected dental costs.

- Exploring payment plans offered by dental offices.

- Considering credit options tailored for healthcare expenses.

Credit: www.lightstream.com

Dental Financing Company Profiles

Interest Rates And Terms

Finding a dental financing solution with favorable interest rates and terms is essential. Patients should look for low-interest options that align with their budget.| Company | Interest Rate | Term Length |

|---|---|---|

| SmileCare | 0-19.99% | 6-60 months |

| Molar Money | 4.99-23.99% | 12-84 months |

| TeethFund | 5.99-17.99% | Up to 72 months |

Reputation And Patient Reviews

Reputation is pivotal in choosing a dental financing company. Real patient reviews offer insights into customer experience and satisfaction.- SmileCare: Known for excellent customer care, most patients report a positive experience.

- Molar Money: Praised for its flexible plans, but some have mentioned higher costs for long-term financing.

- TeethFund: Receives applause for low-interest rates; however, a few note strict eligibility criteria.

Choosing The Right Financing Plan

Evaluating Payment Terms

Key factors to consider while assessing payment terms include:- Interest Rates: Lower rates mean more savings.

- Duration: Shorter terms can lead to higher savings.

- Monthly Payment: Ensure it fits your budget.

- Fees: Watch out for hidden costs.

Understanding Credit Checks And Eligibility

Dental financing companies often perform credit checks to assess risk. They set the terms based on your credit score. Here’s a simple breakdown:| Credit Score Range | Eligibility Level | Typical Interest Rate |

|---|---|---|

| 750 and above | Excellent | Lowest |

| 700 – 749 | Good | Low |

| 650 – 699 | Fair | Moderate |

| Below 650 | Poor | Higher |

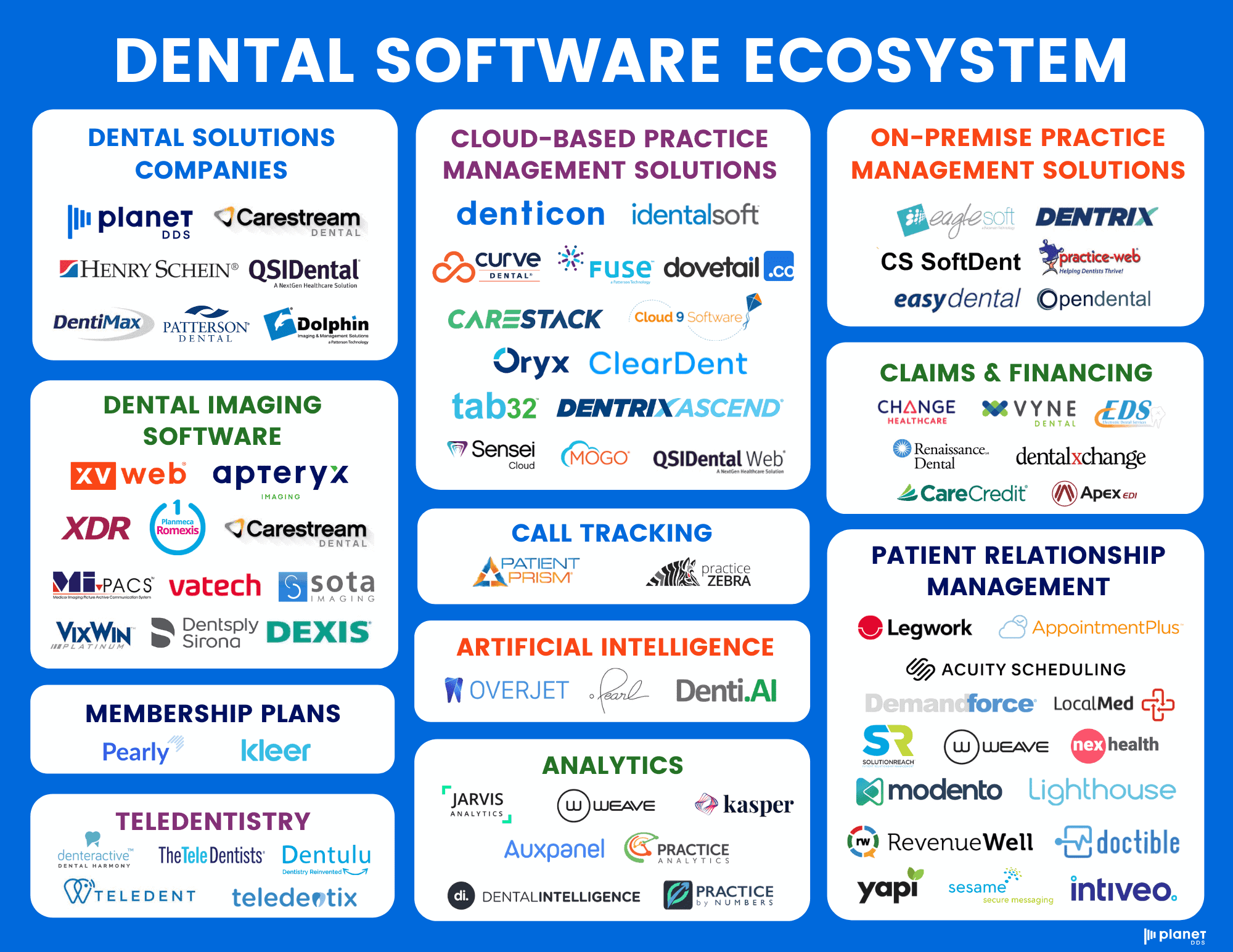

Credit: www.planetdds.com

Impact Of Dental Financing On Patient Care

Enabling Advanced Treatments

Many patients delay or decline advanced dental treatments due to cost. Yet, dental financing companies can change this scenario. They offer flexible plans that cover a range of services. These include routine check-ups, complex surgeries, and cosmetic procedures.- With financing, patients can opt for better technology and materials.

- They can avoid piece-meal treatments, favoring comprehensive care instead.

- Regular payments fit personal budgets, easing financial strain.

The Psychology Of Investing In Dental Health

Financing not only eases the physical aspect of dental care but also the psychological. It fosters a mindset of investment in personal health.

| Without Financing | With Financing |

|---|---|

| Patients may see dental care as a cost | Patients view dental care as an investment |

| May ignore minor issues that can worsen | Handle issues quickly, preventing serious problems |

Frequently Asked Questions For Dental Financing Companies For Patients

What Credit Score Is Needed For Proceed Finance?

A credit score of 620 or higher generally qualifies for Proceed Finance. Higher scores may secure better rates and terms.

What Credit Score Do You Need For Dental Implants?

For dental implants, credit scores typically around 600 to 650 may qualify for financing options. Higher scores improve loan terms.

How Does Icare Financing Work?

ICare financing provides patients with manageable payment plans for healthcare services. Users pay over time, making health costs more affordable without a credit check requirement.

Conclusion

Navigating dental expenses is made easier with financing options tailored for patients. These companies offer plans to fit various budgets, ensuring that oral health is accessible for all. Remember, choosing the right partner can ease the stress of costly dental work.

Embrace the opportunity for a healthier smile without the financial strain.