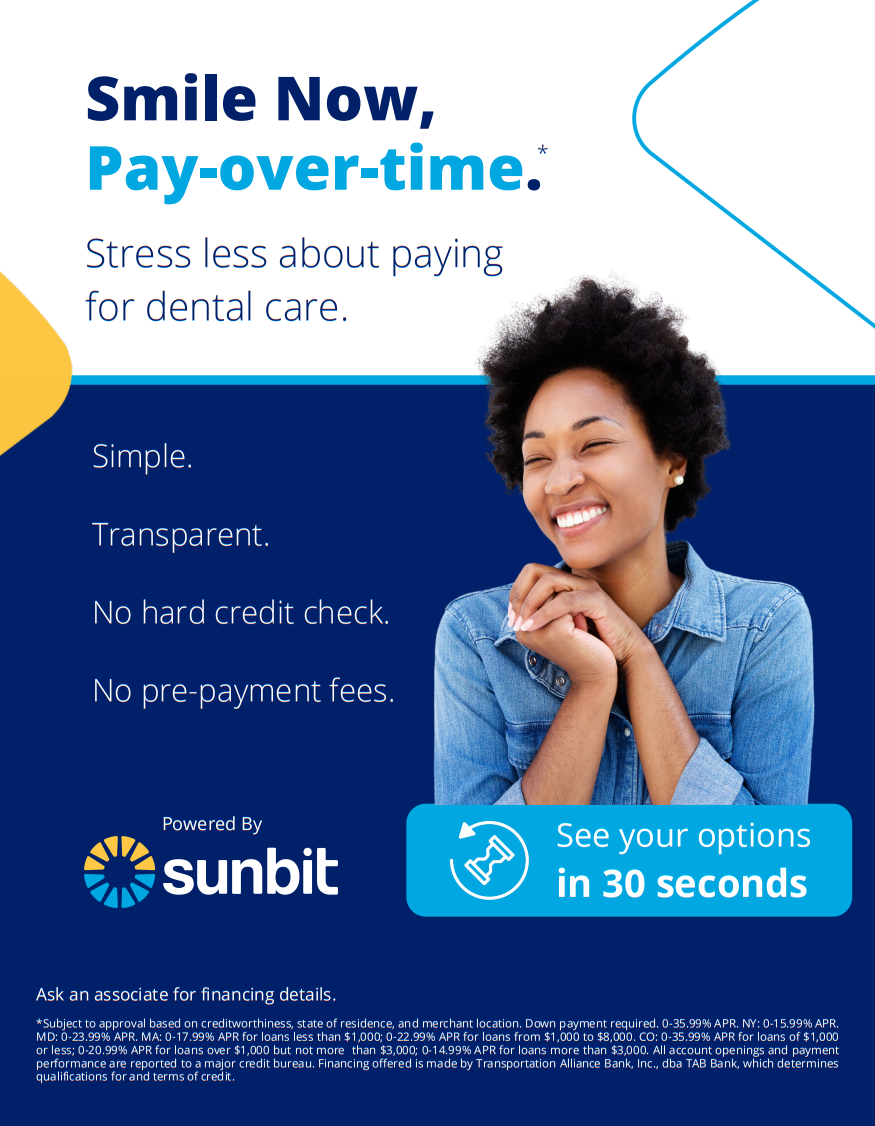

No Credit Check Dental Financing offers patients an alternative to traditional credit-based options. It provides flexible payment plans without the need for a credit history check.

Understanding the significance of oral health, many people seek out dental treatments that can be quite costly. For those with less-than-perfect credit scores, financing dental work can pose a significant challenge, potentially delaying necessary procedures. No Credit Check Dental Financing emerges as a solution to this problem, allowing patients to receive dental care promptly without the stress of stringent credit requirements.

This type of financing typically involves assessing a patient’s ability to pay through means other than traditional credit scoring, such as income verification. As people increasingly look for accessible healthcare options, No Credit Check Dental Financing becomes an essential service for ensuring that dental health is attainable for a broader audience.

Credit: www.creditkarma.com

Navigating Dental Care Costs

The High Price Of Dental Health

Having a healthy smile can come with a hefty price tag. From check-ups to root canals, each procedure adds up. Costs can quickly escalate especially when complex treatments are necessary. Many patients find themselves seeking alternative financial solutions to address the high costs of maintaining dental health.- Check-ups and cleanings

- Fillings and crowns

- Root canals and extractions

- Braces and orthodontic treatments

- Dentures and implants

Insurance And Out-of-pocket Challenges

Dental insurance often covers just a part of the total cost. Patients can face high out-of-pocket fees even if they have insurance. Many insurance plans have annual limits, deductibles, and co-pays, which can make it harder to afford care. Those without insurance struggle even more, as they must cover the full cost on their own.| Insurance Coverage | Out-of-Pocket Expenses |

|---|---|

| Coverage limits and exclusions | Deductibles and co-pays |

| Partial coverage on procedures | Full cost for non-covered services |

The Rise Of No Credit Check Financing

Alternative Financing Solutions

Traditional dental loans are hard if your credit score is low. No credit check options offer a solution. They look at income and stability, not past credit issues. Here are some popular alternatives:- Payment Plans: Many dentists offer in-house plans. This divides your bill into small, manageable payments.

- Medical Credit Cards: Some credit cards are for health services. They often come with promotional interest-free periods.

- Personal Loans: There are lenders who give loans without a deep dive into your credit history.

The Appeal Of A No Credit Check Approach

No credit check financing is a relief for many. It’s simple – your credit score won’t hold you back. Here’s why patients and dentists love it:| Patient Benefits | Dentist Advantages |

|---|---|

| Immediate approval | More paying customers |

| Easy application | Reduced financial discussions |

| Flexible payment options | Improved patient satisfaction |

How No Credit Check Dental Financing Works

Application Process Simplified

Starting the journey to a healthier smile begins with an easy application process. No lengthy paperwork is involved. Patients usually fill out a simple form. Here are the steps often followed:- Visit the dentist’s office or their website.

- Find the financing section.

- Complete a brief form with basic personal details.

- Submit the form and await a prompt response.

Assessing The Terms And Conditions

Understanding the terms and conditions is crucial for a smooth financing experience. Every plan has its own set of rules that dictate repayment and fees. Below is a simple breakdown of what to consider:| Aspect | Details |

|---|---|

| Interest Rates | Often fixed, not influenced by credit score |

| Repayment Period | Varies, could be months to a few years |

| Fees | Some plans may include processing or late fees |

| Payment Frequency | Monthly most common, but may vary |

Credit: www.toothmechanix.com

Pros And Cons Of No Credit Check Options

Immediate Benefits For Dental Procedures

No credit check means fast approval. Dental issues can’t wait. This option puts patient care first.- Get care without delay.

- Bad credit isn’t a roadblock.

- Focus on healing, not finances.

Long-term Implications For Financial Health

It’s crucial to think ahead. Short-term solutions can lead to financial stress later. Understand the impact on your wallet.| Pros | Cons |

|---|---|

| Quick access to dental care | Potential for higher interest rates |

| No credit score damage | May lead to debt accumulation |

| Focused on treatment, not cost | Could impact future financing ability |

Credit: www.denefits.com

Frequently Asked Questions On No Credit Check Dental Financing

What Credit Score Do I Need To Get Dental Implants?

Dental implants typically don’t require a credit score, as they are not a credit product. However, financing options might require good credit, generally above 620, to qualify for loans or payment plans.

Do Dentists Check Your Credit Score?

Dentists generally do not check your credit score for regular appointments or treatments. However, they might do so for financing options or payment plans.

How Does Denefits Work?

Denefits is a financing platform that allows patients to pay for healthcare services through manageable payment plans. Providers get immediate payments, while patients can access treatment without upfront costs.

Conclusion

Navigating dental expenses without credit checks is possible. Dentistry financing options exist for every situation, ensuring smiles all around. Embrace these solutions for your oral health’s future, minus the stress of rigorous credit scrutiny. Start your journey towards a brighter, healthier smile today—credit history aside.