To check car loan details, contact your lender or review your loan documents. Alternatively, use online banking services if available from your loan provider.

Securing a car loan is a pivotal moment for many buyers, setting the wheels in motion for a new vehicle purchase. Understanding your loan specifics, such as repayment terms, interest rates, and the balance owed, is crucial for managing your financial commitments.

Managing a car loan effectively starts with keeping a close tab on the details of the agreement. A common concern for borrowers is maintaining clarity on the specifics of their financing options, which calls for regular monitoring of their loan status. Ensuring you are up-to-date with your car loan details can help in budgeting and could save money over the term of the loan. This proactive financial management often leads to a smoother, more cost-effective loan experience.

Credit: m.facebook.com

Initial Steps To Access Loan Information

Locate Your Loan Documents

Finding your car loan documents is the first critical step. These papers hold essential details about your loan. Look for the initial agreement you signed with the lender. This usually includes your monthly payment, interest rate, and loan term. If you can’t find your documents, contact your lender immediately. They can provide a copy or guide you on how to get one online.Online Account Setup

Today, many lenders offer an online platform to manage your loan. To use this service, create an account on your lender’s website or app. You will need some personal details to register. They include your loan number, Social Security number, or email address. Once set up, you can view statements, track payments, and more. Remember to keep your login details safe.| Feature | Details Available |

|---|---|

| Account Summary | Balance, Next Payment Date, Total Loan Amount |

| Payment History | Dates, Amounts, Remaining Balance |

| Statement Download | Monthly Statement, Year-End Statement |

| Contact Support | Email, Phone Number, Live Chat |

Contacting Your Lender

Customer Service Assistance

Reaching out to customer service is a straightforward approach to resolve any queries related to your car loan. Here’s how you can seek assistance:- Call the helpline: Find the customer service number on your loan documents.

- Email support: Send an email for a detailed, written response.

- Visit in person: Schedule a meeting for face-to-face assistance.

Understanding Your Statement

Your loan statement carries vital information. Decode your statement with these tips:| Section | Details |

|---|---|

| Account Summary | Current balance and payment due |

| Payment History | Record of past payments |

| Interest & Fees | Charges applied to the loan |

| Contact Info | Details for support and inquiries |

Online Platforms And Mobile Apps

Navigating The Website

- Locate the login section on the lender’s homepage.

- Enter your user ID and password.

- View your dashboard for loan summary.

| Section | Details Provided |

|---|---|

| Account Summary | Balance, interest rate, due date |

| Payment History | Date and amount of past payments |

| Manage Payments | Set up or edit your payment account |

Using The Mobile Application

Mobile applications offer convenience with your car loan details at your fingertips. Follow these simple steps:- Download the lender’s app from the App Store or Google Play.

- Open the app and log in with your credentials.

- Access the loan section to view all necessary information.

Credit: www.thompsonsales.com

Understanding Repayment Terms

Interpreting Interest Rates

The interest rate affects the total amount you pay for your car. A lower rate means a cheaper loan. It’s usually a percentage of the borrowed money. Look at this figure carefully. You want it to be as low as possible. The interest rate can be fixed or variable. Fixed rates stay the same. Variable rates can change over time.Amortization Schedules And Balances

An amortization schedule shows how your loan payments break down over time. Early payments go more towards interest than the principal. Later payments flip, with more going towards the loan balance. Use this schedule to track how much you still owe. Add more rows as needed| Month | Principal | Interest | Total Payment | Remaining Balance |

|---|---|---|---|---|

| 1 | $300 | $150 | $450 | $19,550 |

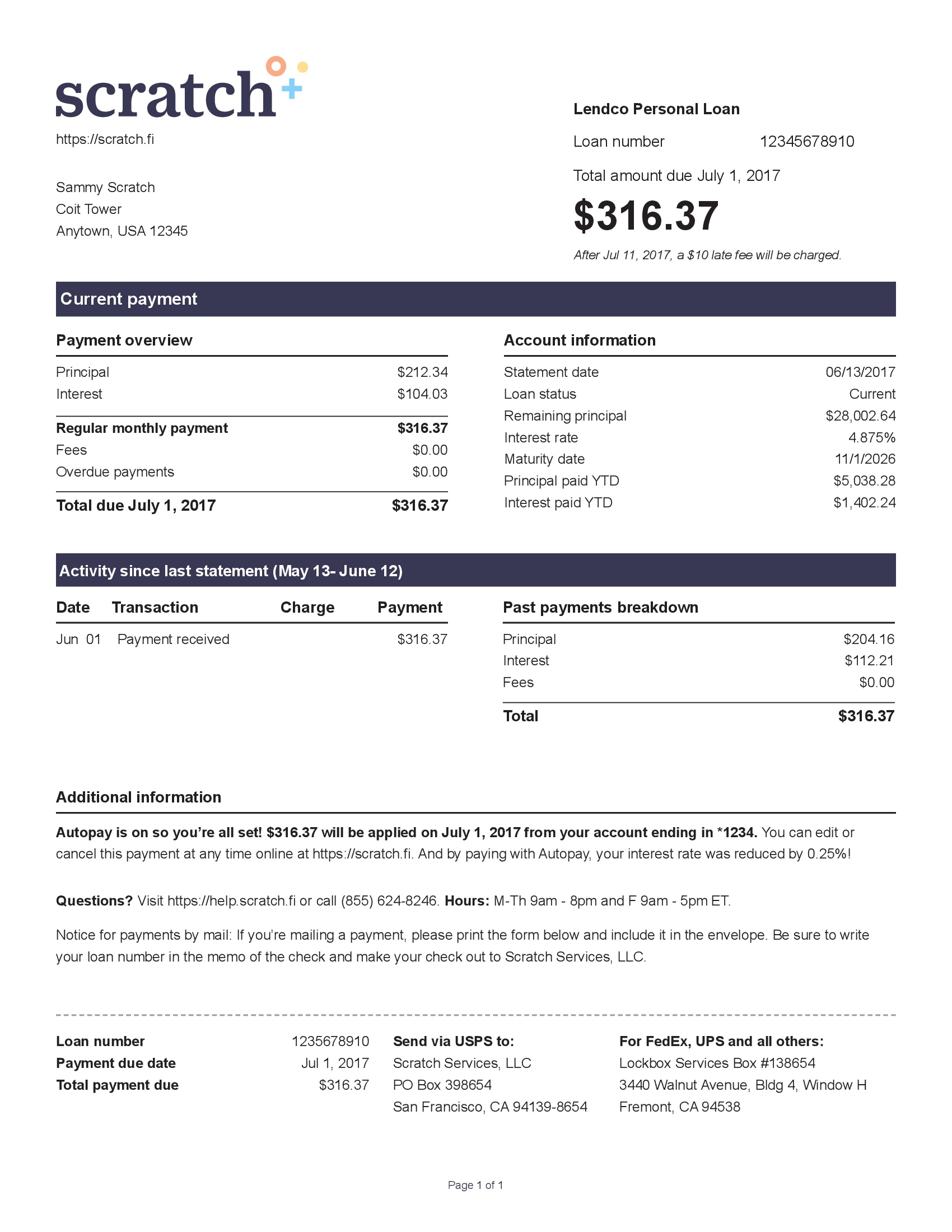

Credit: help.scratch.fi

Frequently Asked Questions On How To Check Car Loan Details

How Do I Check My Auto Loan Balance?

To check your auto loan balance, log in to your lender’s online portal or contact their customer service. Alternatively, check your latest loan statement for the remaining balance.

Can I Check My Car Loan?

Yes, you can check your car loan status online through your lender’s website or by contacting their customer service.

How Do I Check My Loan Balance?

To check your loan balance, log in to your lender’s online portal or contact their customer service. You can also review your latest loan statement for balance details.

Conclusion

Navigating your car loan details doesn’t have to be complicated. By leveraging the tips shared here, you can effortlessly monitor your loan status and stay in charge of your finances. Remember, staying informed helps avoid surprises and ensures a smooth journey to full ownership of your vehicle.

Drive ahead with confidence, knowing your loan is in check.