The Student Loan Forgiveness Application is a process for borrowers seeking debt relief. Eligibility requirements vary based on the forgiveness program.

Navigating the world of student loans can be daunting, especially when seeking financial relief through loan forgiveness programs. With the ever-changing landscape of federal aid, understanding the application process for student loan forgiveness is crucial for borrowers aiming to reduce or eliminate their educational debt.

Clear guidelines and eligibility criteria are outlined by the U. S. Department of Education, allowing for a streamlined path towards managing and potentially discharging student loans. This introduction serves to demystify the process, offering key insights into the steps needed to apply for student loan forgiveness, ensuring that borrowers are armed with the necessary information to take control of their financial future.

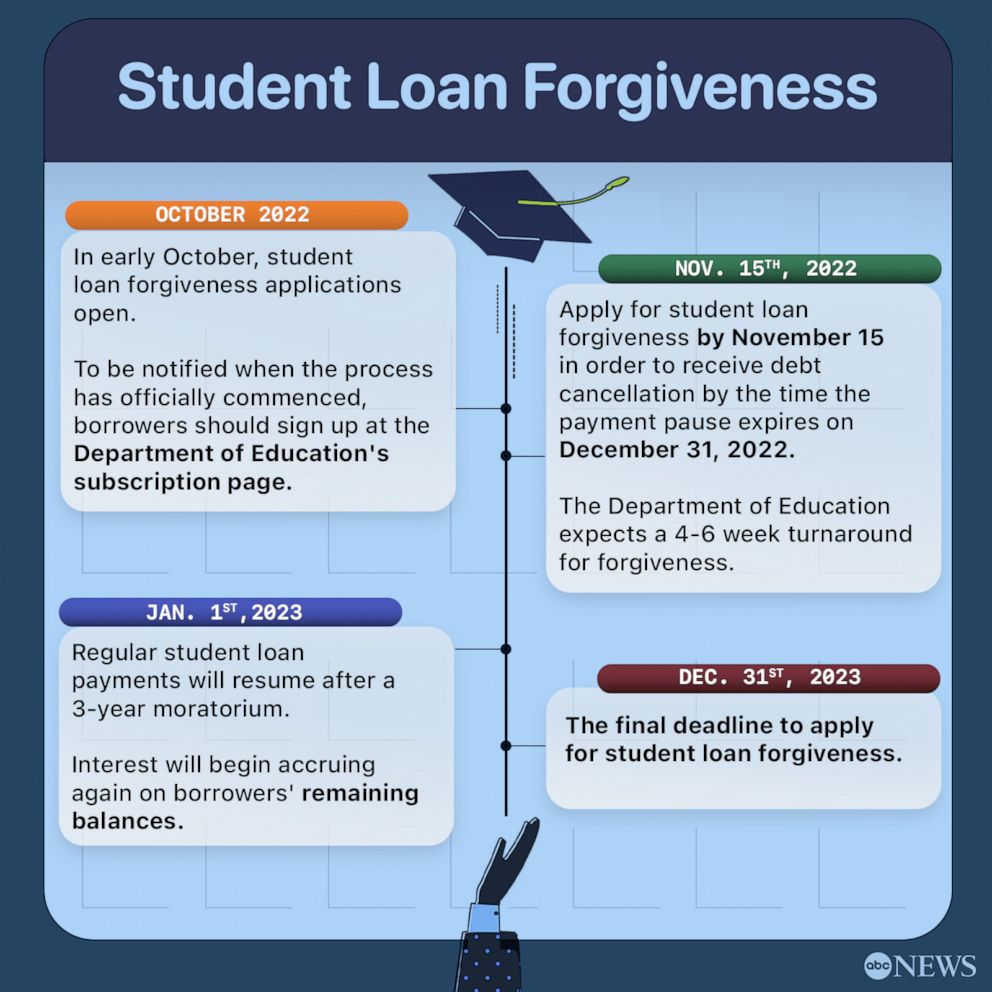

Credit: wset.com

The Path To Student Loan Forgiveness

Eligibility Criteria For Forgiveness Programs

To begin, understanding the qualifications for student loan forgiveness is crucial. Not everyone will meet the standards set by various programs. Each one has its own set of rules.- Type of Loan: Federal loans are often eligible; private loans are not.

- Repayment Plan: Enrolling in income-driven repayment plans may be necessary.

- Employment: Work in public service or for a non-profit may qualify you.

- Payment History: Consistent, on-time payments over a period can be a requirement.

- Loan Status: Only loans in good standing typically qualify.

Documentation And Application Process

Once eligibility is confirmed, the next step is to gather all required documentation. Be meticulous to ensure a smooth application process.| Documentation | Details |

|---|---|

| Loan Statements | Evidence of your outstanding loan balance and payment history. |

| Income Proof | Documents that verify your current income level. |

| Employment Certification | Confirmation of employment in a qualifying organization. |

| Application Forms | Completed forms that each program specifically requires. |

Credit: abc7ny.com

Navigating Through Different Forgiveness Plans

Public Service Loan Forgiveness (pslf)

Devote yourself to public service? You might have your loans forgiven. The Public Service Loan Forgiveness plan is for government and non-profit workers. Here’s how to qualify:- Work full-time for a qualifying employer.

- Make 120 qualifying payments under a repayment plan.

- Submit the PSLF form to track your progress.

| Requirement | Details |

|---|---|

| Employment Type | Government, 501(c)(3) non-profit, or qualifying non-profit |

| Payment Count | 120 qualifying payments |

| Repayment Plan | Qualifying repayment plan (e.g., IDR plans) |

Income-driven Repayment (idr) Plans

Need a payment based on your income? Income-Driven Repayment plans adjust your monthly payment. Your income and family size matter here. Payments become more manageable. These plans also lead to loan forgiveness.- Choose a plan: PAYE, REPAYE, IBR, or ICR.

- Recertify your income every year.

- Pay over 20-25 years, remaining balance gets forgiven.

| Plan Name | Payment Cap | Period for Forgiveness |

|---|---|---|

| PAYE | 10% of Discretionary Income | 20 years |

| REPAYE | 10% of Discretionary Income | 20 years for undergraduate 25 years for graduate |

| IBR | 10-15% of Discretionary Income | 20-25 years |

| ICR | 20% of Discretionary Income or fixed payments over 12 years | 25 years |

Tips For A Successful Application

Common Application Mistakes To Avoid

Filling out your Student Loan Forgiveness Application with care helps avoid delays or denials. Here’s what to steer clear of:- Incomplete information: Fill out all required fields. Leaving blanks may result in a rejected application.

- Incorrect details: Double-check all personal information. Mistakes here may cause unnecessary complications.

- Outdated documents: Use the most current financial statements. Ensure all supporting docs reflect your current situation.

- Lack of signatures: Sign where required. Electronic or written, a signature verifies your identity and intention.

Maintaining Eligibility And Handling Rejections

To keep your Student Loan Forgiveness prospects alive, you must stay eligible. Here’s how to maintain your path to forgiveness:- On-time payments: Always pay loans when due. Timely payments show lenders your commitment.

- Certification: Keep your employment certified. Regular updates prove your job still qualifies for forgiveness.

- Re-certification: Annual income updates are required. They ensure you’re on the right payment plan.

- Review reasons: Understand why your application was turned down. The rejection notice will detail specific issues.

- Correct mistakes: Address the listed problems. Amend your application with the right information.

- Reapply: Don’t hesitate to submit your application again. Make sure it’s error-free to increase your chances of success.

Credit: blog.getintocollege.com

The Future Of Loan Forgiveness

Policy Changes And Their Implications

In recent times, student loan forgiveness policies have witnessed significant shifts, impacting both current borrowers and future generations. Here’s what’s expected in the realm of policy:- Expansion of Qualification Criteria: More borrowers may qualify for forgiveness.

- Simplification of Application Process: A streamlined process could encourage more applications.

- Changes in Repayment Plans: Adjustments likely align repayment plans with forgiveness goals.

Resources For Staying Informed

To stay updated on loan forgiveness initiatives, consider the following resources:- Official Government Websites: They provide authoritative, up-to-date information.

- News Outlets: Reputable media organizations often cover policy changes.

- Educational Blog Platforms: These platforms discuss the implications of legal changes.

- Financial Aid Offices: School offices offer personalized advice tailored to individual situations.

Frequently Asked Questions For Student Loan Forgiveness Application

When Can I Apply For Student Loan Forgiveness?

You can apply for student loan forgiveness once you meet the eligibility criteria set by your loan provider. Check with them or the U. S. Department of Education for specific timelines and programs.

Is There An Application To Fill Out For Student Loan Forgiveness?

Yes, applicants seeking student loan forgiveness typically must complete a specific application provided by their loan servicer or the U. S. Department of Education.

How Do I Automatically Qualify For Student Loan Forgiveness?

To automatically qualify for student loan forgiveness, enroll in an income-driven repayment plan, work in a qualified public service job, make consistent payments for the required period, and complete the paperwork for Public Service Loan Forgiveness (PSLF).

Conclusion

Navigating the maze of student loan forgiveness doesn’t have to be intimidating. With a strategic approach to your application, the path to reducing your educational debt is clearer. Remember, staying informed and up-to-date with guidelines ensures your best chance at approval.

Take that step towards financial freedom – your future self will thank you.