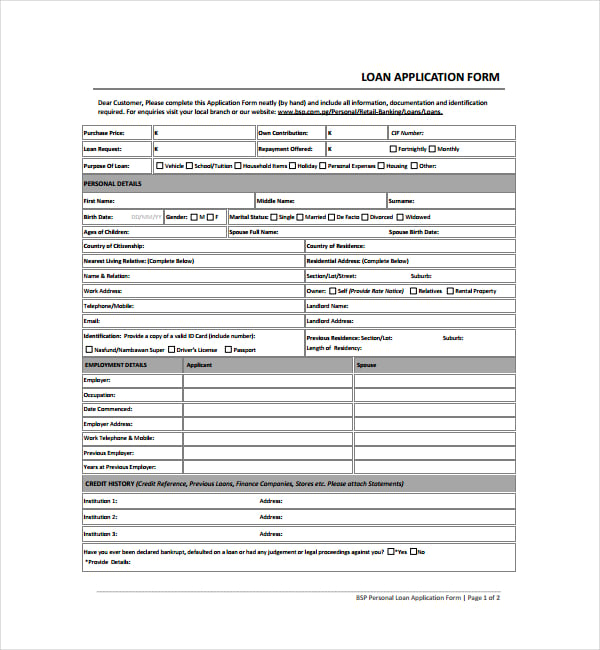

A Simple Loan Application Form for an Employee is a document an employee fills out to request a loan from their employer. It often requires personal and financial information.

Crafting an SEO-friendly content piece about a Simple Loan Application Form for Employees entails focusing on the essentials that applicants and HR managers seek. Understanding the form’s relevance is crucial in today’s dynamic workplace where financial support options can foster employee loyalty.

Employees often encounter unexpected expenses, and having access to a straightforward loan application process can alleviate stress and improve workplace morale. Employers offering this benefit need to ensure the form is user-friendly, promoting a supportive company culture. By simplifying the loan application process, companies can enhance their reputation as caring employers, benefiting both staff retention and their employer brand.

Credit: www.pdffiller.com

Crafting A Streamlined Employee Loan Application Form

Key Components Of A User-friendly Form

All employee loan application forms must have these features:- Personal Information: Full name, employee ID, department.

- Loan Details: Amount requested, purpose, repayment terms.

- Income Verification: Recent payslips or income statements.

- Agreements: Terms and conditions acknowledgment.

- Signatures: Sections for both employee and authority signatures.

Designing A Clear Layout For Quick Processing

The layout of the application form is just as important as the information it collects.- Divide the form into sections to avoid confusion.

- Use bold headers to identify different parts.

- Employ check boxes and drop-down menus for easy selection.

- Include clear instructions for each field to be filled out.

Essential Information To Include

Personal Details And Employment Verification

First, personal details confirm who is applying for the loan. This section helps verify the employee’s identity. Below is the vital data the form must capture under this part:- Full Name: This should be the employee’s legal name.

- Address: Current living address, including zip code.

- Contact Information: Phone numbers and email addresses.

- Social Security Number: Used to identify the employee.

- Date of Birth: Helps in verifying the age of the employee.

| Item | Description |

|---|---|

| Employee ID | A unique number given to the employee by the company. |

| Position | Title of job role within the company. |

| Department | The segment of the business where the employee works. |

| Hire Date | The day the employee started working with company. |

Loan Amount And Repayment Terms

The form must clearly state the loan amount requested. It should also lay out how the employee plans to pay it back. Here are the specific points to cover:- Loan Request Amount: The exact sum the employee wants.

- Repayment Schedule: The timing for payments (weekly, bi-weekly, monthly).

- Repayment Period: How many months or years to pay off the loan.

- Interest Rate: If any interest is added to the loan.

- Reason for Loan: Brief explanation of why the money is needed.

Ensuring Legal Compliance

State And Federal Regulations Governing Employee Loans

Understanding the legal landscape is key to drafting compliant loan application forms for employees. State and federal guidelines dictate how these loans can be issued. Factors to consider include interest rates, repayment terms, and loan limits. Employers must comply with:- Fair Labor Standards Act (FLSA): It regulates wage deductions and ensures they do not bring pay below minimum wage.

- Truth in Lending Act (TILA): It requires transparent disclosure of loan terms to protect consumers.

- State laws: These can differ greatly, so employers must check local regulations carefully.

Protecting Privacy And Financial Information

Guarding personal data is essential in today’s digital age. When employees submit loan applications, they entrust sensitive information to their employer. The following are best practices to ensure privacy:- Secure storage: Use encrypted databases to store employee data safely.

- Restricted access: Only authorized personnel should access these forms.

- Clear policies: Have written privacy policies regarding the handling of financial information.

Credit: ie.pinterest.com

Streamlining The Approval Process

Setting Up An Assessment Criteria

Clearly defined criteria pave the way for transparent loan approval. Here’s how you can set the stage for success:- Employment Tenure: Consider how long an employee has been with the company.

- Income Level: Verify monthly or annual earnings to assess repayment capacity.

- Repayment History: Check past loan or credit repayments.

- Purpose of Loan: Ensure the reason for borrowing aligns with company policy.

Integrating Quick Decision-making Practices

Efficiency is key in loan processing. Speed up decisions with these steps:- Automate: Use software to collect and analyze application data.

- Prioritize: Deal with urgent applications first.

- Train Staff: Educate your team on assessing applications fast.

Credit: www.template.net

Frequently Asked Questions On Simple Loan Application Form For Employee

How Do I Write A Loan Application Form?

To write a loan application form, start with personal details (name, address, job). Clearly state the loan amount and purpose. Outline your income and expenses. Provide supporting documents as required. Sign and date the form before submitting to the lender.

How Do I Write A Loan Application Letter To My Company?

To write a loan application letter to your company, address your employer directly, state the amount you need and the reason for the loan. Provide a detailed repayment plan. Keep the tone professional and thank your employer for considering your request.

What Is Standard Loan Application Form?

A standard loan application form is a document that borrowers complete to request a loan from a financial institution. It typically includes personal, employment, and financial information to assess creditworthiness.

Conclusion

Navigating through the loan application process can be daunting. With the simple form created for employees, the journey becomes smoother. Remember, preparation is key to a quick, favorable response. Start with clarity on your needs, gather required documents, and fill in your information.

Embark on a hassle-free financial path today.